Welcome to the CodeAce Algo Tradingview Indicator, your comprehensive tool for making informed and strategic trading decisions. This user guide will walk you through the key features and functionalities to maximize your trading experience.

Table of Contents

How To Apply Indicator with Tradingview

Rules to use the indicator ( Mandatory / Important )

Recommended timeframe & Assets

Highly accurate Buy/Sell signals

Strong signal analysis

Proper entry, stoploss & target points

Smart trail to maximize your reward

Trend continuation sign

Risky trade sign

Multi timeframe trend analysis table

Real time signal scanner

Support Resistance

Configurability at your fingertips

1. How To Apply Indicator with TradingView

- Once you have made the payment, our support team will provide access to you.

- Open TradingView.

- Click on “Indicator” in the top menu.

- A popup for Indicators will appear.

- Navigate to the “Invite Only Scripts” section.

- Look for the indicator that starts with “Trend Catcher …” created by CodeAce Algo.

- Select the indicator.

- Apply the selected indicator to the chart.

- Please review the complete user guide for other settings and functionalities.

2. Rules to use The indicator ( Mandatory / Important)

Rules for Using Our TradingView Indicator:

- Review Policies: Before using our TradingView indicator, carefully review all the policies outlined on our website to ensure compliance and understanding.

- Initial Recommended Subscription : Do not opt for a quarterly or yearly subscription until you feel comfortable and confident about the indicator’s performance and your trading patterns.

Review Policies: Before using our TradingView indicator, carefully review all the policies outlined on our website to ensure compliance and understanding.

Paper Trading: Start by practicing paper trading for at least one week to familiarize yourself with the indicator’s signals and performance without risking real capital.

Initial Trading: After the paper trading period, begin trading with one lot size for a duration of 2-3 weeks. This phase allows you to gauge the effectiveness of the indicator in live market conditions with minimal risk.

Gradual Scaling: Gradually increase your position size based on your risk tolerance and reward expectations. Consider factors such as account size, risk management strategies, and market conditions before scaling up.

- Risk Management: Always prioritize risk management and adhere to strict risk-reward ratios when trading with our indicator. Set stop-loss orders and establish clear exit strategies to mitigate potential losses.

- Disclaimer: While our indicator aims to assist traders in making informed decisions, trading involves inherent risks, and past performance is not indicative of future results. We do not guarantee profits or bear responsibility for any losses incurred while using our indicator. Traders are advised to exercise caution, conduct thorough research, and seek professional advice if needed before trading.

By following these rules and exercising diligence and caution, traders can use our TradingView indicator effectively while minimizing risks associated with trading.

3. Recommended timeframe & Assets*

For optimal performance and accurate analysis with our TradingView indicator, we recommend utilizing the following timeframes:

Equity & Indices

- Minimum: 3 minutes

- Maximum: 15 minutes

MCX (Multi Commodity Exchange):

- Minimum: 5 minutes

- Maximum: 15 minutes

NOTE: Always pick up the asset which will have good volatility and movement everyday, Eg: Reliance, HDFC BANK, NIFTY INDEX, Banknifty Index

Not Applicable for : Forex

These recommended settings ensure effective signal generation and insightful market analysis across different asset classes, allowing traders to make informed decisions within the specified timeframe ranges.

4. Highly accurate buy/sell signals

The CodeAce Algo Trading Indicator provides timely and accurate buy and sell signals, allowing you to make well-informed decisions. Follow these steps to interpret the signals:

5. Strong signal analysis

Dive deeper into market conditions with strong signals that incorporate advanced technical parameters. Gain insights into market trends with the Strong Signal Analysis feature:

Enable Smart Trail: off

Note: Please make a note that, strong means higher probability,

6. Proper entry, stoploss, and target points

The indicator displays clear entry points, stop loss, and three target levels for each trade. Follow these guidelines for effective trade execution.

Enable Smart Trail setting: off

Enable Smart Trail Setting : on

7. Smart trail to maximum your reward

Activate the Smart Trail feature to capture significant reward while the trend is in your favor. Maximize your gains by following these steps.

Enable Smart Slow/Fast Trail setting: off

Enable Smart Slow Trail Setting : on

Enable Smart Fast Trail Setting : on

8. Trend continuation sign

Stay in your current trade confidently with the Yellow Trade Continuation Sign. This feature guides you to exercise patience and maximize your gains

9. Risky trade Sign

Identify potentially risky trades with the Risky Trade Signal. Take calculated risks with limited quantities, especially in smaller trends

10. Multi Timeframe trend analysis helper table

Gain valuable insights into the current trend across multiple time frames. The Trend Helper Table includes daily open interest and put-to-call ratio

11. Real time screener

Stay ahead of the game with our real-time screener, displaying signals as they are generated. Capture the most lucrative trades and increase your overall win ratio

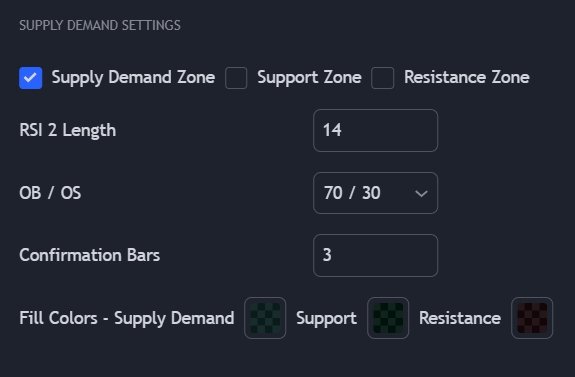

12. Support & Resistance

You Can Plot or add Support & Resistance on the chart

- Support and resistance levels can act as psychological barriers for traders. Market participants tend to remember previous price levels and react accordingly when the price approaches these levels again.

- Once a support level is breached, it may become a resistance level, and vice versa. This phenomenon is known as “role reversal.”

- Support and resistance levels are not fixed and can change over time as market conditions evolve.

- Stronger support and resistance levels are often identified by higher trading volumes and longer periods of consolidation around those levels.

- Traders often use support and resistance levels to make trading decisions, such as entering trades near support levels and exiting trades near resistance levels.

You can see below screenshot how support help to understand the trend is reversed and can have more potential with new trend

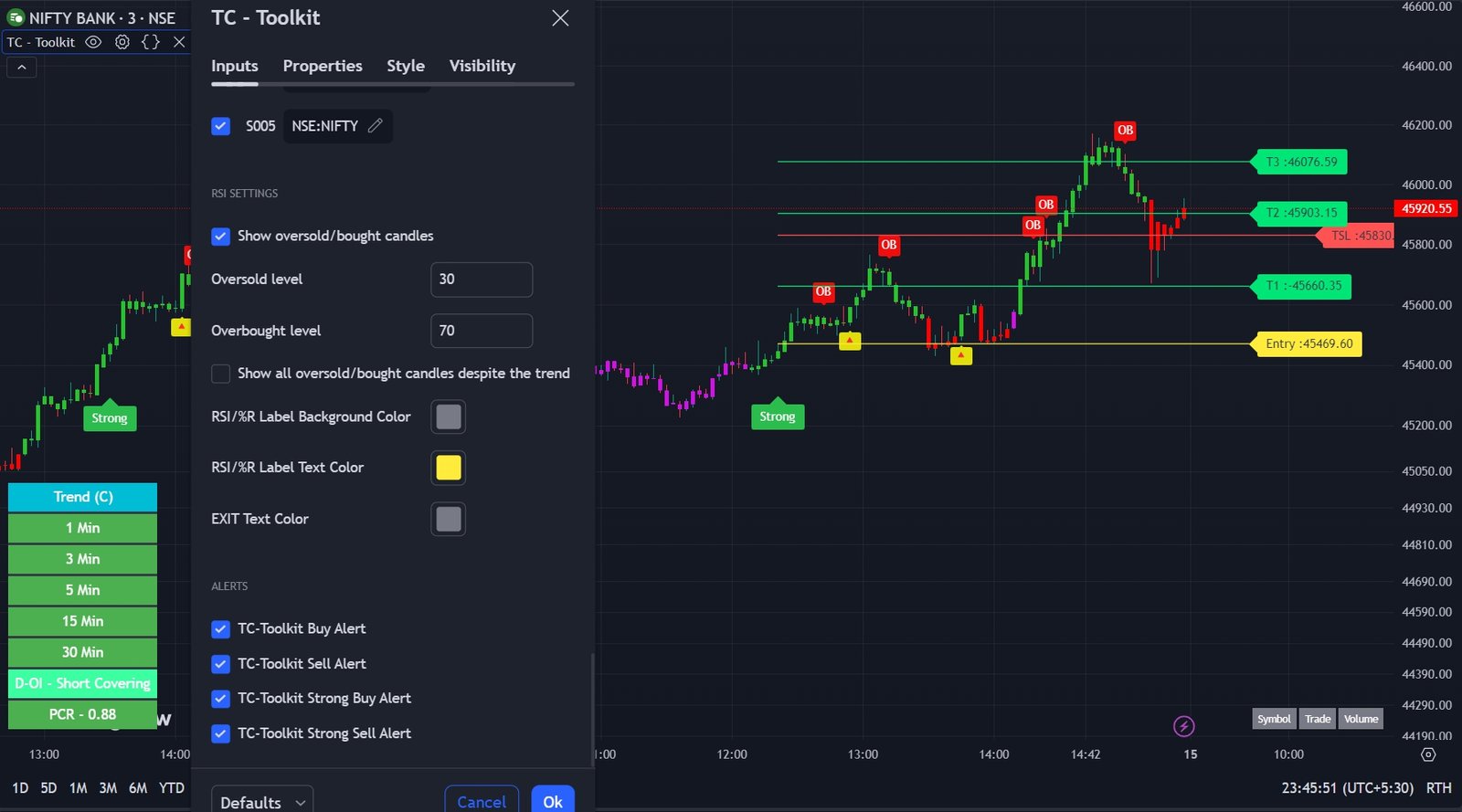

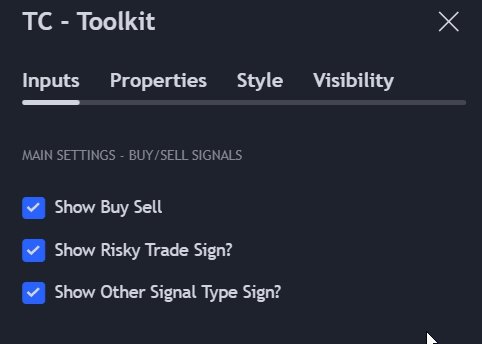

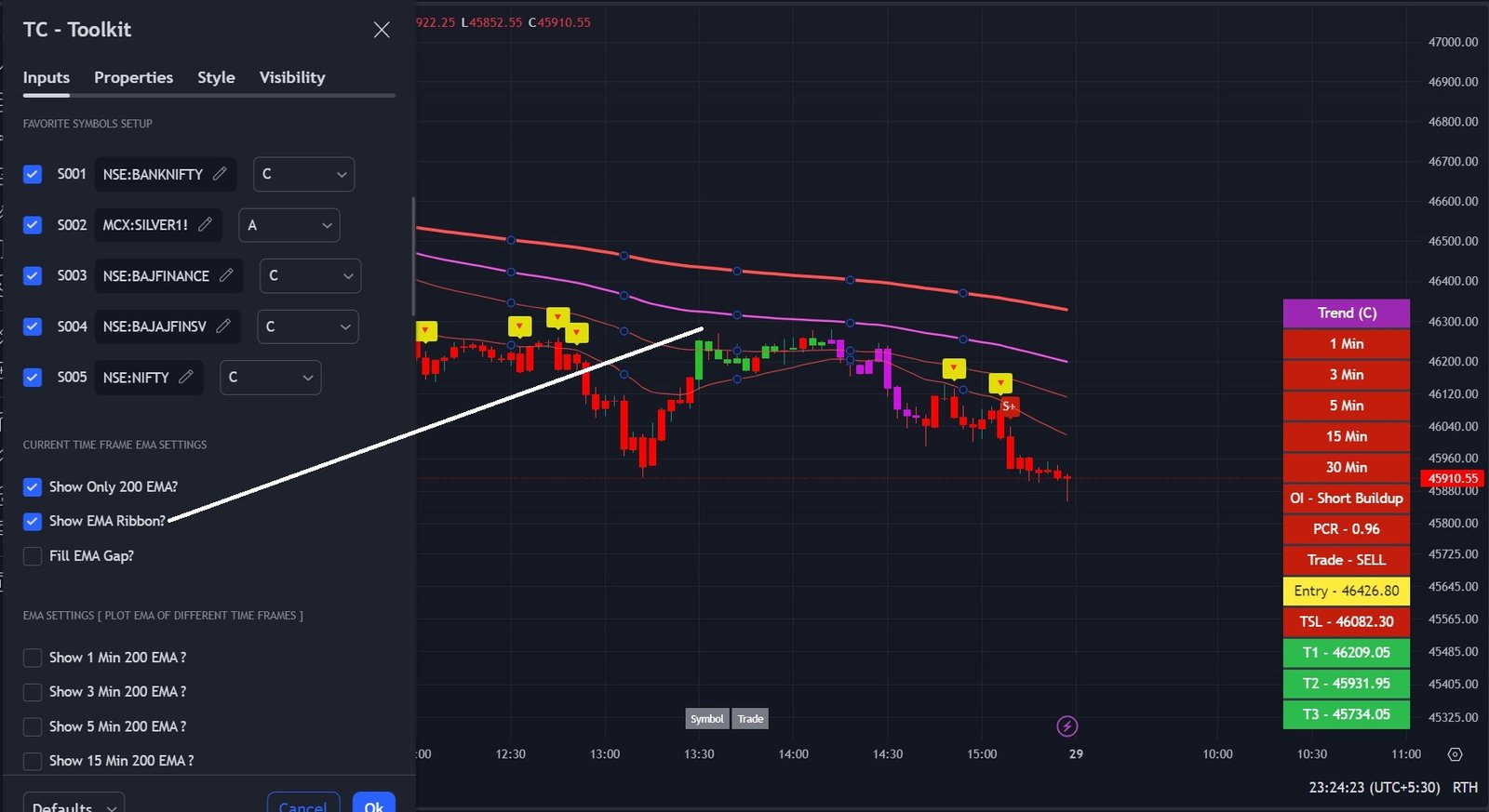

12. Configurability at your fingertips

Customize every aspect of the indicator to suit your trading style. All settings are configurable, ensuring a personalized and tailored experience

Show Buy Sell

- Enable Setting : to display the buy or sell signal on the chart

Show Risky Trade Sign

- Enable Setting : to display the Risky ( R) Sign, This sign indicate that trend may not extend more, so trade with small qty with low risk.

Show Other Signal Type Sign

- Enable Setting :

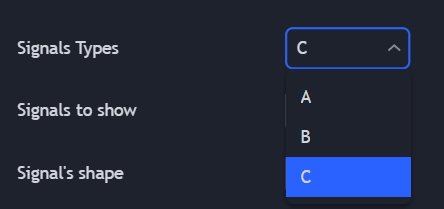

At CodeAce Algo, we’ve implemented a dynamic signal display feature to provide users with comprehensive insights into trading signals. With our platform, you can choose from three distinct signal types (A, B, and C) to generate buy or sell signals based on your preferences and market conditions.

When you select a specific signal type, such as Type C, our system intelligently tracks and displays the generated signals on your trading chart. In the event of a sell signal, for example, the corresponding candle will be marked accordingly.

But here’s where our system goes the extra mile: if a sell signal is generated under Type C and is later replicated under Type A or B, our platform will automatically append a modifier to the signal display. In this case, a “(S+)” sign will be added to the respective candle, indicating that the same sell signal has been confirmed across multiple signal types.

This enhanced signal display not only provides clarity but also highlights the strength and consistency of trading signals across different strategies. With CodeAce Algo, you can make informed trading decisions backed by robust and reliable signal analysis.

Signal’s Addon Settings

At CodeAce Algo, we understand that one size does not fit all when it comes to trading strategies. That’s why our platform offers the flexibility to tailor your signal strategies to suit specific stocks or assets.

We offer a range of signal types, each designed to cater to different market conditions and asset classes. Whether you’re trading stocks, commodities, or forex, you can customize your strategy to optimize performance for your chosen assets.

For example, Strategy A may be well-suited for volatile assets like BankNifty, while Strategy B could be more effective for stable commodities like Silver. With our customizable settings, you have the flexibility to adjust parameters such as entry points, stop-loss levels, and target prices to align with the unique characteristics of each asset.

By empowering users to customize their signal strategies, we ensure that you can adapt to changing market conditions and maximize your trading opportunities effectively. Experience the power of tailored strategies with CodeAce Algo and take your trading to the next level.

Show Trending Candle Colors

- Bullish : Color of the bar when trend is up

- Bearish : Color of the bar when trend is down

- Neutral : Color of the bar when market is sideways or flat

Show EMA Ribbon

Ema ribbon is the combination of the 20,50,100,200 ema, which help’s to understand the current trend.

EMA Settings:

Plot the 200 EMA of different timeframe, Let’s take example, if you selected the 3 min time frame, still you can plot the like 1 min, 5 min, 15 min upto daily 200 ema.

it’s helps for support and resistance.

Trend Helper Table

- Show Table : Enable trend helper table

- Position : Position of the table, left bottom or top, or right bottom/top.

- Show Vertical Table : Enable table vertical otherwise horizontal.

- Show All Timeframe Table : By default displaying the small time frame current trend, if want to see higher timeframe like 1 /2/4 hr , daily & weekly then enable the option

- Show Daily, 15, 30 Min OI : All the above options are to see the open interest based on the given timeframe, which always helps to understand the options status.

- Show PCR: Displaying the PCR status, that’s also help to identify the market trend.

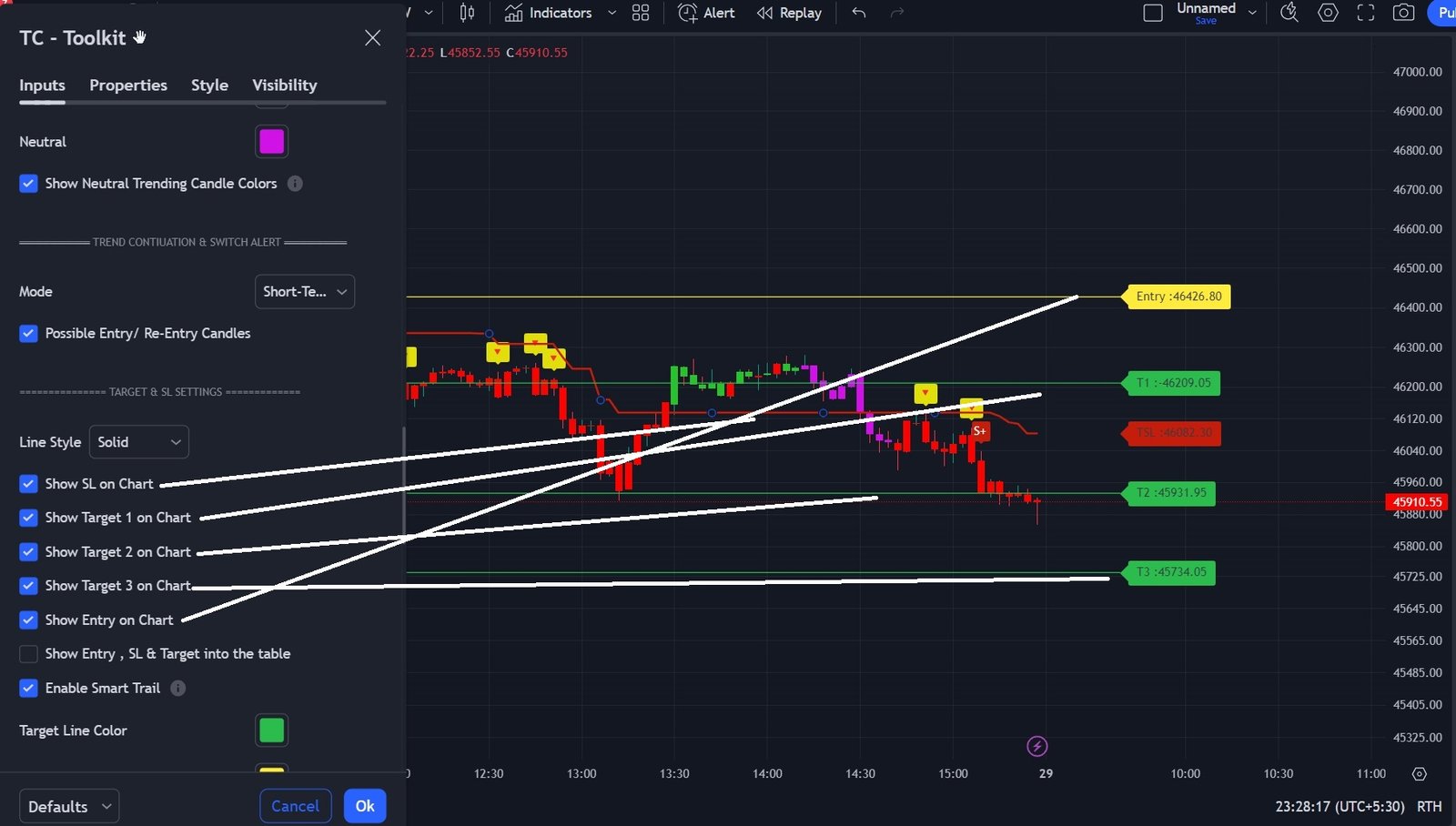

Target & SL Settings

- Show SL on Chart

- Show Target 1 on chart

- Show Target 2 on chart

- Show Target 3 on chart

- Show Entry on chart

—- all above setting to plot the Entry, SL & Targets

- Show Entry , SL & Targets into the table : it’s display the Entry , SL & Targets Price into the table

- Enable Smart Trail : Activate the Smart Trail feature to capture significant reward while the trend is in your favor. Maximize your gains by following these steps.

Additional Settings

- Entry, SL & Target Line Color

Show Ichimoku :

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction.

Possible Entry or Re-Entry Candle Sign:

Stay in your current trade confidently with the Yellow Trade Continuation Sign. This feature guides you to exercise patience and maximize your gains.

it’s Trend Continuation sign

Screener Settings

- Enable Stock Screener : Enable it if want to catch the real time for specific 5 stocks ( Associated in the setup )

- Table Position : Position of the screener report table

- Add Alert : Setup Alert ( Please make sure you have setup alert through trading view , only in that case this setting will work )

- Symbols : User can customize the attached stocks, can select any 5 stocks, screener will be work only for those stocks.

RSI Settings:

Show oversold/bough candles: it will help to take reward or exit based on oversold or overbought sign